A company’s cash strategy plays a critical role in its ability to grow sustainably. Cash flow management, access to capital, and prudent budgeting determine whether a business can seize new opportunities or falter under pressure. Assessing if your cash strategy supports growth involves more than just tracking revenues and expenses; it requires a forward-looking approach that aligns financial resources with business objectives.

Positive cash flow is often viewed as a sign of health, but it is the quality and predictability of that cash flow that matters most for growth. Seasonal fluctuations, delayed payments from clients, or unexpected expenses can quickly strain resources. Companies aiming for expansion must forecast cash inflows and outflows over several months to ensure enough liquidity to cover operational costs and investments.

A static cash position provides limited insight. Instead, dynamic cash flow models that factor in projected sales growth, marketing expenses, hiring costs, and equipment purchases create a clearer picture of funding needs. This type of analysis can highlight periods when cash may tighten and help management plan accordingly.

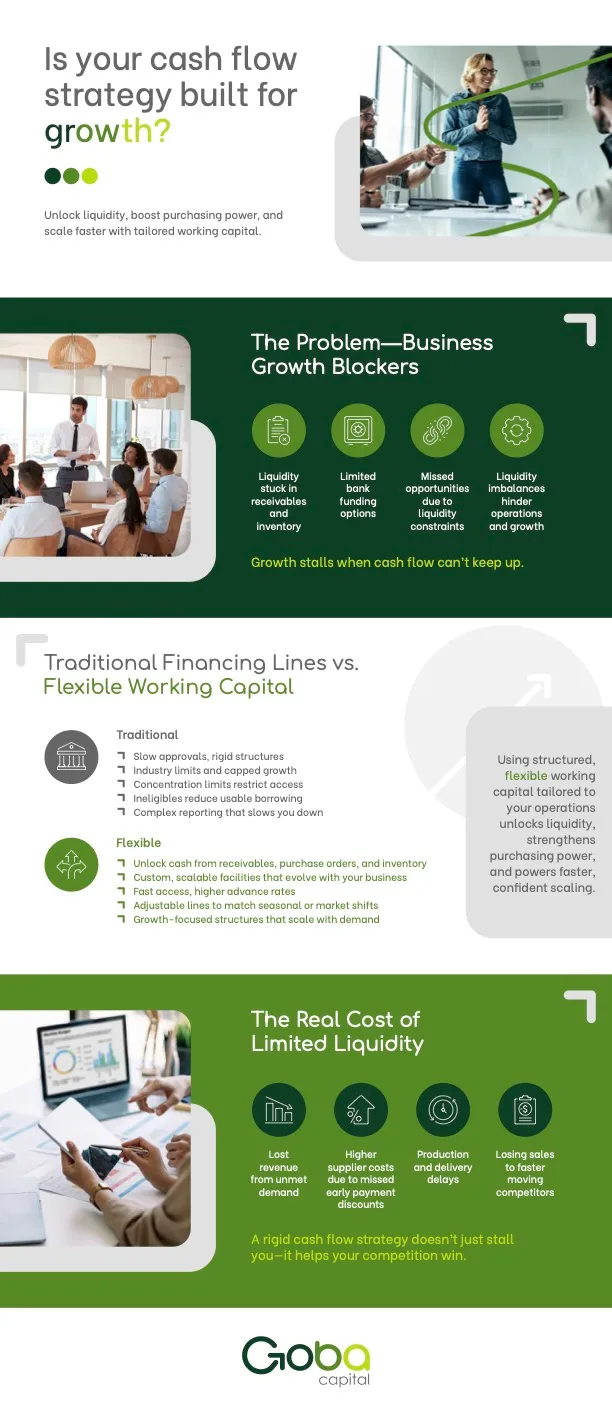

Growth often requires capital infusion, whether for product development, entering new markets, or increasing production capacity. Understanding which financing solutions best fit your business’s stage and goals is essential. Debt financing, equity investments, and lines of credit each come with unique risks and benefits.

Debt can offer quick access to funds but introduces repayment obligations that affect cash flow. Equity financing reduces immediate financial burden but dilutes ownership and control. Lines of credit provide flexibility but can carry higher interest rates and fees if not managed carefully. Choosing the right mix depends on your business model, growth timeline, and risk tolerance.

Maintaining operational efficiency during growth phases helps prevent cash shortages. Companies should regularly review their expense structures and eliminate unnecessary costs. Investing in automation, negotiating supplier contracts, or consolidating services can free up cash without sacrificing quality.

Cash reserves act as a buffer against unexpected events, such as market downturns or supply chain disruptions. A growth-ready cash strategy balances reinvestment in the business with prudent saving to maintain resilience.

Tracking key financial metrics can signal whether your cash strategy supports growth. Metrics like the cash conversion cycle, days sales outstanding, and current ratio provide insight into how quickly cash is generated and how well short-term obligations are met.

Regular financial reviews and scenario planning allow businesses to adjust strategies as market conditions shift. Using these insights to refine budgeting, investment, and financing decisions strengthens the company’s foundation for growth.

A cash strategy built for growth anticipates future needs, adapts to changing circumstances, and aligns closely with strategic goals. Firms that actively monitor cash flow quality, select appropriate financing solutions, and manage expenses effectively position themselves for long-term success. Growth is not only about generating revenue but ensuring that the financial infrastructure can support expansion without compromising stability. Look over the infographic below to learn more.